cash flow from assets is defined as

Cash flow from assets is defined as. Cash flow factors can be used to calculate parameters to measure organizational performance.

/applecfs2019-f5459526c78a46a89131fd59046d7c43.jpg)

Comparing Free Cash Flow Vs Operating Cash Flow

This section includes accounts receivable accounts payable.

. Operating cash flow plus the cash flow to creditors plus the cash flow to. Boperating cash flow plus the cash flow to creditors plus the cash flow to shareholders. The term cash flow is used to describe the amount of cash that is generated or spent within a certain time frame.

Cash flow from operating CFO indicates the amount of cash that a company brings in from its regular business activities or operations. Operating cash flow minus cash flow to creditors. For example a movement of 100 as.

Doperating cash flow plus net capital spending plus the change in net. Athe cash flow to shareholders minus the cash flow to creditors. Cash flow is the broad term representing the full amount of both income and expenses of your business.

Cash flow from investment activities are caused by payments made into investment vehicles loans made to other entities or the purchase of fixed assets. Cash flow generated by operations. Operating cash flow minus the change in net working.

Remember that the cash flows to total assets ratio has nothing to do with income or profitability. What Does Cash Flow From Operations Mean. Coperating cash flow minus the change in net working capital minus net capital spending.

Cash flow is the total amount of income flowing in and out of your business. In finance the term is used to describe the amount of cash currency that is generated or consumed in a given time period. Negative cash flow occurs when a company has more money going out the door such as to buy inventory cover operating expenses or pay other bills than it has coming in.

Tap card to see definition. Cash flow is a measure of a businesss total cash inflows less cash outflows. The cash flow to shareholders minus the cash flow to creditors.

Businesses take in money from sales as revenues and spend money on expenses. The cash flow to shareholders minus the cash flow to creditors. Its easy to mix up cash flow with profit and working capital so its important to distinguish the difference.

Cash flow from assets plus cash flow to creditors. Cash flow from assets refers to a businesss total cash from all of its assets. Cash Flow CF is the increase or decrease in the amount of money a business institution or individual has.

Cash flow to stockholders is defined as. The cash flows to total assets ratio shows investors how efficiently the business is at using its assets to collect cash from sales and customers. Cash flow from assets is the aggregate total of all cash flows related to the assets of a business.

In most cases the term outflow refers to large movements on a company account. So it does not necessarily determine your profit. Click card to see definition.

Cash flow from assets can be defined as a cash flow to shareholders minus the Course Hero Cash flow from assets can be defined as a cash flow School California State University Stanislaus Course Title FIN 3220 Uploaded By melissay185 Pages 26 This preview shows page 10 - 12 out of 26 pages. Cash flow is the amount of cash that comes in and goes out of a company. This refers to the net cash generated from a companys investment-related activities such as investments in securities the purchase of physical assets like equipment or property or the sale of assets.

Net income minus the addition to retained earnings. Operating cash flow plus the cash flow to creditors plus the cash flow to shareholders. This information is used to determine the net amount of cash being spun off by or used in the operations of a business.

Operating cash flow minus the change in net working capital minus net capital spending. Operational cash flows are those originating from the organizations internal business. Cash Flow to Creditors Cash Flow to Stockholders Click again to see term.

View full document See Page 1 5. It is calculated by taking a companys 1 net income. The higher the ratio the more efficient the business is.

There are many types of CF with various important uses for running a business and performing financial analysis. Dividends paid minus net new equity raised. Operating activities include generating revenue paying expenses and funding working capital.

Investment cash flows are those originating from assets and capital expenditures. Investing cash flow. Cash flow from assets is defined as.

It determines how much cash a business uses for its operations with a specific period of time. Positive cash flow indicates that a companys liquid assets and. Net capital spending plus the change in net working capital.

Cash flow from assets is defined as. Cash flow from operations also called operating cash flow refers to the amount of cash garnered from a business core activities. Its important to remember that cash flow differs from profit.

In a sentence an outflow is a movement of cash out of a bank account that may or may not occur at the same time as the associated cost. Operating cash flow plus net capital spending plus the change in net working capital. Cash flow from assets can be defined as.

Cash outflows related to fixed asset purchases can spike shortly after the start of a new fiscal year right after the annual capital budget has been approved. Cash flow to shareholders minus net capital spending minus the change in net working capital. The concept is comprised of the following three types of cash flows.

Smaller cash movements are usually called disbursements. It only has to do with the efficiency of. However it does not factor in money from other financing sources such as selling stocks or debts to offset negative cash flow from assets.

When a companys liquid assets exceed its short-term liabilities it is considered cash flow positive. Dividends paid plus the change in retained earnings. Cash Flow From Assets.

This is typically calculated by taking a companys net income factoring in depreciation expenses then adjusting for any gains or losses on sales and assets. They may also receive income from interest. In healthy companies that are actively investing in their businesses this number will often be in the negative.

That represents the amount of cash a company generates or consumes from carrying out its operating activities over a period of time. Financing cash flows are those originating from the issuance of debt or equity.

How Do Net Income And Operating Cash Flow Differ

Free Excel Spreadsheets And Templates Cash Flow Forecast Template Xls 2017 Free Excel Spreadsheets An Cash Flow Excel Spreadsheets Templates Excel Spreadsheets

Pinterest Cash Flow Forecast Template Xls 2017 Excel Xls Templates F848bfbb Resumesample Resumefor Cash Flow Excel Spreadsheets Templates Excel Spreadsheets

Budgeted Balance Sheet Importance Steps Adjustments And More Cash Budget Budgeting Accounting Basics

Magicbrad Presents On Robert Kiyosaki S Cash Flow Quadrant Kiyosaki Robert Kiyosaki Cash Flow

Chapter 23 Statement Of Cash Flows Mc Computational Flashcards Quizlet

Accounting Solutions Inventory And Control Audit Accounting Business Account Business

What Is Capital Structure And Why It Matters In Business Fourweekmba Cash Flow Statement What Is Capital Profit And Loss Statement

Amalgamation Vs Merger Learn Accounting Money Management Advice Accounting And Finance

Intangible Assets List Top 6 Most Common Intangible Assets Intangible Asset Asset Accounting And Finance

Cash Flow Statement Excel Template Is Being Use Through The Financial Manager Of The Company To Monitor Cash Stre Cash Flow Statement Excel Templates Cash Flow

Sources And Uses Of Funds Statement Aka Cash Flow Statement

Types Of Adjusting Entries In Accounting Process Accounting Education Accounting Books Accounting Basics

/AppleCFJune2019-7034d23092e14723b39c1c22f5e170b3.jpg)

Cash Flow From Investing Activities Definition

Payback Period Metric Defined Calculated Shorter Pb Preferred Payback Business Case New Product Development

Asset And Liability Report Balance Sheet For Excel Excel Templates Balance Sheet Balance Sheet Template Excel Templates

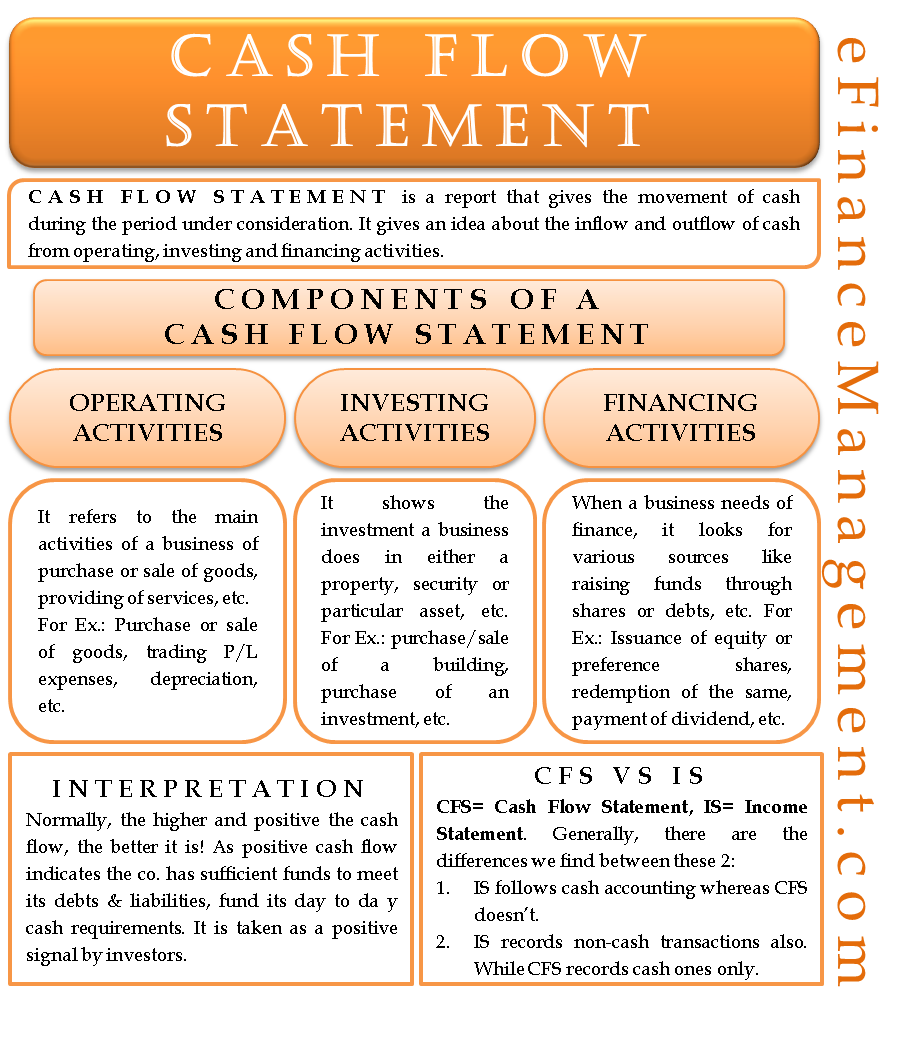

Cash Flow Statement Meaning 3 Components Examples

Towercrest Capital Management Wealth Management Business Risk Wealth

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-01-369e05314df242c3a81b8ac8ef135c52.jpg)